Stress Testing Kit: A journey of growth and iterative innovation

Aleksandar Gucunja, Senior Manager at EY

What is stress testing?

We live in stressful times. Global pandemics and military crises, inflation higher than seen in decades as well as banking crisis that led to the failure of some of the key financial institutions, all characterize the time we live in. And who is affected? Everyone. During these uncertain times, the entire economy needs support from banks. But what if the bank fails? What if banks need additional support? To prevent banks’ failure, regulatory bodies require banks to perform analysis to determine whether they have enough capital to withstand economic or financial crisis. In banking, this is known as stress testing.

Regulators and supervisors require all banks to conduct stress tests and report the results on a regular basis. Stress tests focus on a few key areas such as credit risk, market risk and liquidity risk to measure financial status of banks in crisis and its’ ability to face challenges. More than 5000 financial institutions in EU are performing stress tests right now.

This is, quite often, a demanding task for banks for a myriad of reasons, such as: calculation complexity and duration, regulatory pressure in terms of short deadlines and constantly growing requirements, the delay between the CRO asking the proverbial ’What happens if we change this?’ question and the analyst delivering an appropriate reply. Finally, integration between different kinds of risks is difficult to achieve.

What is Stress Testing Kit and what is it used for?

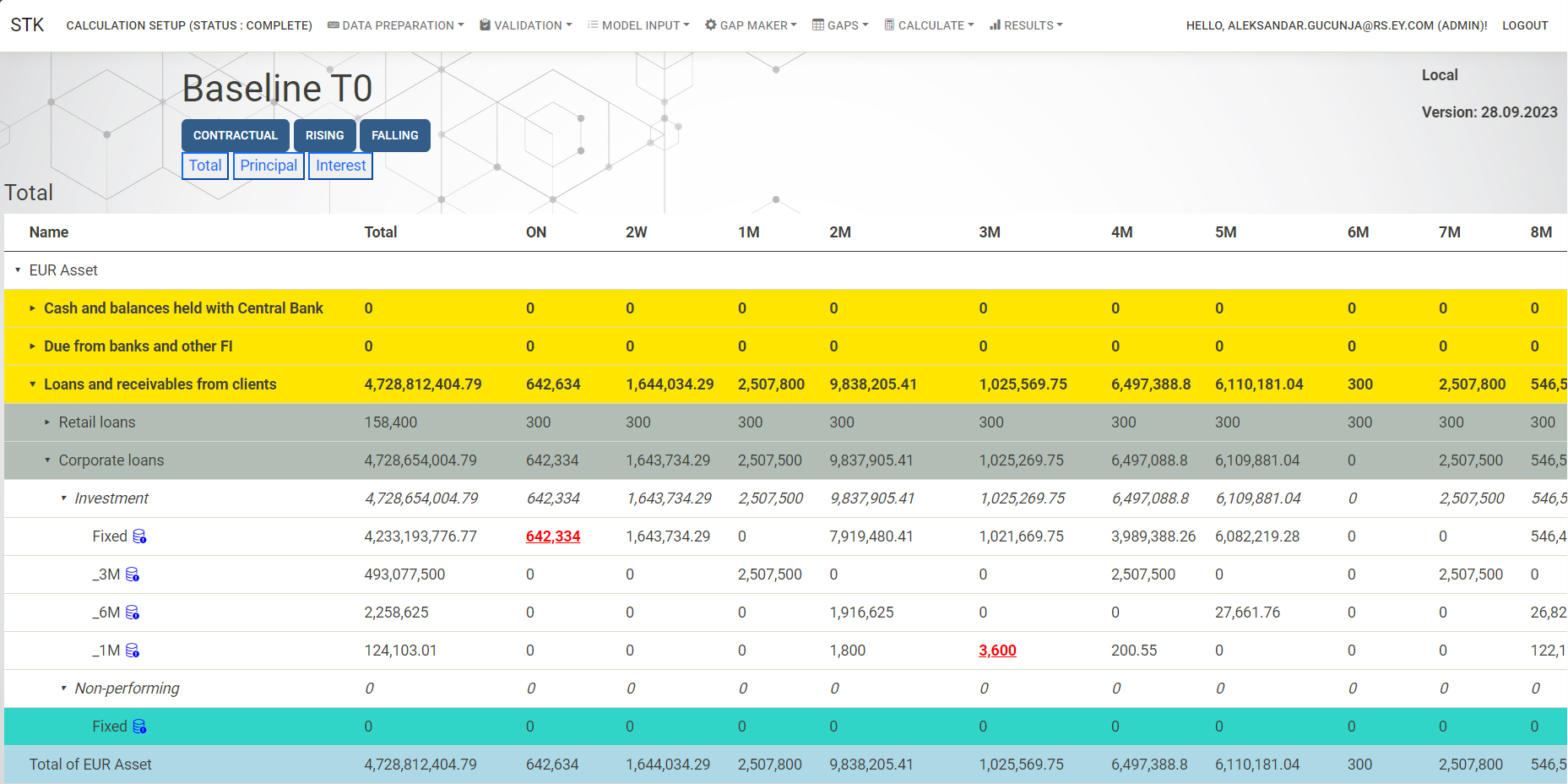

STK is a lightweight and transparent solution specially designed for credit institutions in order to facilitate stress testing for various purposes and general risk management. Developed to perform bottom-up stress testing, the Stress Testing Kit has been a game-changer for our banking clients, providing them with new insights into their risk exposure and capital adequacy. However, as its complexity grew, so did the challenges of ensuring its seamless functioning for an increasing number of users and features. Our team realized that, to maintain the software’s effectiveness, scaling was not just an option – it was necessary.

Stress Testing Kit possesses a suite of essential features crucial for organizations seeking to fortify their risk mitigation strategies. This solution boasts rapid implementation, empowering banks to swiftly adapt to evolving risk scenarios. Its flexibility enables customization to suit the unique needs of diverse business models. The predefined input data model simplifies data integration, ensuring a seamless transition for users. One of its standout attributes is the absence of any ‘black-box’ risk, providing complete transparency in any risk assessment. Moreover, it comes with a low accompanying investment, making it accessible to a wide range of enterprises. By adhering to the latest regulatory standards and market practices, this software serves as a future-proof solution for risk management.

It conveys key messages to management through user-friendly interfaces, and its comprehensive documentation ensures that every aspect of the system is easily understood. This software represents an incremental advancement in the field of risk management, aligning perfectly with the ever-evolving needs of modern businesses. The versatility of STK extends across a spectrum of critical use cases within the realm of risk management. It serves as a foundational tool for internal capital requirements calculation, facilitating precise and data-driven assessments of capital needs. Furthermore, users can create challenger models, enabling organizations to rigorously assess their risk models and make informed decisions. When it comes to ICAAP stress testing, this software provides an invaluable platform for stress scenario simulations and regulatory compliance, ensuring the resilience of financial institutions.

For in-depth scenario analysis, it offers the necessary flexibility and precision to model a wide range of risk scenarios, empowering organizations to make proactive strategic choices. In the context of recovery plans, this software provides essential insights for crafting effective strategies to navigate periods of crisis. Additionally, its real-time capabilities make it an indispensable asset for day-to-day risk management, enabling organizations to monitor, identify, and mitigate risks efficiently. Lastly, it excels in estimating changes in the risk profile due to the introduction of new products, equipping businesses with the foresight needed to navigate the intricacies of evolving markets and products successfully.

Plan for the future

Stress Testing Kit is being developed sequentially by modules. Having in mind the current regulatory agenda (EBA’s Guidelines on IRRBB and CSRBB, EBA/ GL/2022/14), we tackled modules covering Interest Rate Risk first, meaning EVE and NII sensitivity modules are ready to be shipped to our clients at this moment. Next on the list are Liquidity and FX risk modules, which are on track to be completed by year-end. This will finalize the ALM-risks suite of STK. For the remaining four modules covering Credit (IFRS9 and RWA perspectives separately), Operational and Concentration risks, the plan is to have them production-ready by mid-next year, together with quality-of-life features such as real-time market data through Refinitiv or Bloomberg integration.

Written by: Aleksandar Gucunjа, EY